Thursday, 27 September 2012

Wednesday, 26 September 2012

Oil Price Dip is a Buying Opportunity

Posted on 10:12 by Unknown

On 17 September 2012, talk about a possible release of oil from the U.S. strategic petroleum reserve was put on the table. Since that announcement, the oil price has dropped 10% from $100/barrel to $90/barrel. These strategic petroleum reserves are only to be used during emergencies defined as follows:

The biggest reason for this release of the SPR is obviously the turmoil in the Middle-East of which I talked about here. Other reasons are said to be because of the presidential election. The question is, how long can this release of the SPR put a lid on rising oil prices?

The strategic petroleum reserves are currently standing at 695 million barrels, while the U.S. uses 20 million barrels a day according to the Department of Energy. This means that when all of the reserves were to be released, we will have 695/20 = 35 days of extra emergency supply. So basically, oil prices would only drop for a month and then quickly rise again afterwards. Moreover, the U.S. wouldn't release all of its SPR at once, but is likely to release a small part of it. The U.S. has only released its SPR a few times in history, the first time it released its SPR was on January 1991 and the last time was on 23 June 2011. All of these releases were on average in the amount of 30 million barrels. Which is about 1.5 days of supply, too few to have any significant long-term effect on the oil price.

The first release of SPR was on January 1991 under the Bush administration due to the war in Iraq. The U.S. released 17.3 billion barrels from its oil reserves. Oil prices had spiked from an average of $25/barrel to $50/barrel due to the Gulf War. After the release of SPR, the oil price returned to its average of $25/barrel. Last year on 23 June 2011, due to the Libyan crisis, the International Energy Agency (IEA) once again released 60 million barrels of oil, of which the U.S. contributed half of it. The effect was a 10% drop in oil prices. But the oil price quickly recovered a few months later.

Conclusion:

I believe the recent 10% drop in oil prices is overdone and should be a buying opportunity for investors, especially in terms of gold (Chart 1). The reason behind this logic is found in the amount of supply of the SPR, which is only 35 days maximum and probably 1.5 days if we look at history. Additionally QE3 was announced a few weeks ago and it should be very beneficial to the price of oil going forward. Investors can bet on a rebound in the price of oil by buying iPath Crude Oil ETN (OIL) or United States Oil Fund (USO).

- an emergency situation exists and there is a significant reduction in supply which is of significant scope and duration;

- a severe increase in the price of petroleum products has resulted from such emergency situation; and

- such price increase is likely to cause a major adverse impact on the national economy.

The biggest reason for this release of the SPR is obviously the turmoil in the Middle-East of which I talked about here. Other reasons are said to be because of the presidential election. The question is, how long can this release of the SPR put a lid on rising oil prices?

The strategic petroleum reserves are currently standing at 695 million barrels, while the U.S. uses 20 million barrels a day according to the Department of Energy. This means that when all of the reserves were to be released, we will have 695/20 = 35 days of extra emergency supply. So basically, oil prices would only drop for a month and then quickly rise again afterwards. Moreover, the U.S. wouldn't release all of its SPR at once, but is likely to release a small part of it. The U.S. has only released its SPR a few times in history, the first time it released its SPR was on January 1991 and the last time was on 23 June 2011. All of these releases were on average in the amount of 30 million barrels. Which is about 1.5 days of supply, too few to have any significant long-term effect on the oil price.

| Figure 1: Releases of SPR (Source: Bianco Research) |

|

| Chart 1: Light Crude to Gold Ratio |

Conclusion:

I believe the recent 10% drop in oil prices is overdone and should be a buying opportunity for investors, especially in terms of gold (Chart 1). The reason behind this logic is found in the amount of supply of the SPR, which is only 35 days maximum and probably 1.5 days if we look at history. Additionally QE3 was announced a few weeks ago and it should be very beneficial to the price of oil going forward. Investors can bet on a rebound in the price of oil by buying iPath Crude Oil ETN (OIL) or United States Oil Fund (USO).

Long Idea: Platinum!

Posted on 08:32 by Unknown

In an interview from Peter Schiff on 25-September-2012 with the CEO of Sandstorm Gold, Nolan Watson, I noticed that platinum production costs are now almost the same as the platinum price. This is very significant as every price drop in platinum will render platinum mines nonviable for business.

Several articles like these have popped up recently and it's almost certain that the platinum price will go up due to supply concerns. South African miners are very inefficient and their costs are rising rapidly due to inflation.

Nolan Watson told us that the price of gold hasn't kept pace with rising inflation. This means that the gold price should already be at $2000/ounce just to be on par with the inflation as compared to 4 years ago. Basically this means that gold is now cheaper than 4 years ago if we count in inflation.

And platinum will be even better!

Just look at the platinum gold ratio (Chart 1). It is forming a bottom and should go higher, meaning higher prices of platinum versus gold.

I will be long platinum for the time being.

|

| Figure 1: Price versus Operating Cost (Gold, Silver, Platinum, Palladium) |

Several articles like these have popped up recently and it's almost certain that the platinum price will go up due to supply concerns. South African miners are very inefficient and their costs are rising rapidly due to inflation.

Nolan Watson told us that the price of gold hasn't kept pace with rising inflation. This means that the gold price should already be at $2000/ounce just to be on par with the inflation as compared to 4 years ago. Basically this means that gold is now cheaper than 4 years ago if we count in inflation.

And platinum will be even better!

Just look at the platinum gold ratio (Chart 1). It is forming a bottom and should go higher, meaning higher prices of platinum versus gold.

I will be long platinum for the time being.

|

| Chart 1: Platinum Gold Ratio |

Wednesday, 19 September 2012

Stock Alert: St. Augustine Gold & Copper Ltd

Posted on 10:35 by Unknown

A very interesting development has been spotted in a gold-copper mine I talked about before here. I noted that the Philippines' gold and copper resources were ranked in the top 5 in the world. At the time of that article, St. Augustine Gold & Copper Ltd. (SAU) was at CAD 0.3/share. Just recently, the share price of the company jumped up to CAD 0.4/share on news that Australia based CGA Mining Ltd. (CGA) is going to be bought out by B2Gold Corp. for $1.1 billion. Read more about this news here.

Tuesday, 18 September 2012

China Construction Bank to Buy European Bank: RBS or Commerzbank?

Posted on 13:14 by Unknown

On 16 September 2012, China Construction Bank (CCB) announced that it would use up to $15 billion dollars to buy a stake (30%-50% stake or full acquisition) in a European bank. CCB chairman Wang Hongzhang said he would target banks in France, Germany and the United Kingdom. He indicated that some of the European banks are "on sale". The most interesting candidates are to be found in the partly nationalised banks, because it allows the government to reprivatise the banks. This way, the treasury is allowed to recoup its investment after having bailed out the banks during the economic crisis. The likely candidates are Royal Bank of Scotland (RBS), Lloyds (LYG) and Commerzbank (CRZBY.PK). Today the U.K. government controls a 82% stake in the Royal Bank of Scotland (RBS) and a 41% stake in Lloyds. The German government holds a 25% stake in Commerzbank. If this deal were to go through, it would shatter the $5.5 billion record held by Industrial and Commercial Bank of China (ICBC) for its purchase of a 20% stake in South Africa's Standard Bank in 2007.

We will go through the numbers, the earnings and choose which bank will be the likely target.

Find out here.

We will go through the numbers, the earnings and choose which bank will be the likely target.

Find out here.

Sunday, 16 September 2012

The correlation between M1 and Gold: Quantifying how much the USD will devalue due to QE3

Posted on 06:31 by Unknown

Ben Bernanke recently announced QE3 and it is estimated by Bank of America that the federal reserve balance sheet will go to $5 trillion in two years from now (end of 2014). If we know that the federal reserve balance sheet will go to $5 trillion in two years from now, I want to point out what this means to the U.S. dollar denominated in gold (GLD). How much depreciation in U.S. dollars can investors expect due to QE3? For the answer we need to take a look at the money supply measures of M0 and M1.

On Chart 1 we see the current Federal Reserve Balance Sheet and this balance sheet correlates to base money M0 (Chart 3). M0 (or monetary base) is basically the U.S. dollars and coins in your wallet (Chart 2) (biggest part of M0 namely "currency in circulation") (not in the bank) + deposits held by depository institutions at Federal Reserve Banks.

As you can see, currency in circulation was going up very steadily together with the federal reserve balance sheet during the period 1985 till 2008. We went from around $200 billion in 1985 to $800 billion in 2008. Then suddenly the federal reserve balance sheet exploded by $2 trillion, while the currency in circulation (your money in your wallet) only went up $300 billion. That means the federal reserve's increase in balance sheet (printing of money) hasn't adequately increased currency in circulation.

The extra $2 trillion in QE3 recently announced by Ben Bernanke (expansion of the federal reserve balance sheet) is expected to have the same effects. This is because all of the expansion in the federal reserve balance sheet is going to the excess reserves of depository institutions (Chart 4). You can find these excess reserves by simply subtracting Chart 2 (Currency in Circulation) from Chart 3 (M0: Base Money).

This will give Chart 4: Excess Reserves of Depository Institutions. This increase in excess reserves is seen by many to be a sign that inflationary pressure will come to the U.S. economy and the U.S. dollar.

One simple model for determining the long-run equilibrium exchange rate is based on the quantity theory of money: MV=PT. Money x Velocity = Price x Transaction. A one-time increase in the money supply is soon reflected as a proportionate increase in the domestic price level (everything becomes more expensive). The increase in the money supply is also reflected as a proportionate depreciation of the currency against other foreign currencies.

The question is, how much depreciation will we see in the U.S. dollar against the real currency: Gold?

You can find the answer here.

Chart 3: Base Money (M0) |

On Chart 1 we see the current Federal Reserve Balance Sheet and this balance sheet correlates to base money M0 (Chart 3). M0 (or monetary base) is basically the U.S. dollars and coins in your wallet (Chart 2) (biggest part of M0 namely "currency in circulation") (not in the bank) + deposits held by depository institutions at Federal Reserve Banks.

As you can see, currency in circulation was going up very steadily together with the federal reserve balance sheet during the period 1985 till 2008. We went from around $200 billion in 1985 to $800 billion in 2008. Then suddenly the federal reserve balance sheet exploded by $2 trillion, while the currency in circulation (your money in your wallet) only went up $300 billion. That means the federal reserve's increase in balance sheet (printing of money) hasn't adequately increased currency in circulation.

The extra $2 trillion in QE3 recently announced by Ben Bernanke (expansion of the federal reserve balance sheet) is expected to have the same effects. This is because all of the expansion in the federal reserve balance sheet is going to the excess reserves of depository institutions (Chart 4). You can find these excess reserves by simply subtracting Chart 2 (Currency in Circulation) from Chart 3 (M0: Base Money).

This will give Chart 4: Excess Reserves of Depository Institutions. This increase in excess reserves is seen by many to be a sign that inflationary pressure will come to the U.S. economy and the U.S. dollar.

One simple model for determining the long-run equilibrium exchange rate is based on the quantity theory of money: MV=PT. Money x Velocity = Price x Transaction. A one-time increase in the money supply is soon reflected as a proportionate increase in the domestic price level (everything becomes more expensive). The increase in the money supply is also reflected as a proportionate depreciation of the currency against other foreign currencies.

The question is, how much depreciation will we see in the U.S. dollar against the real currency: Gold?

You can find the answer here.

Predictions all Came True!

Posted on 01:47 by Unknown

Just a little pat on my own back.

QE3 was announced on 13-14 September 2012, it was predicted that they would by MBS and bonds, Eric Sprott premiums on silver went up, bond yields went up, LCNS went up, silver broke out.

All predicted in this August 2012 article.

Now the only thing that remains is the JPM silver manipulation. That will ultimately happen when physical shortages in silver start to emerge and we already see that happening. So brace yourself for a spike in silver!

See Kingworldnews: Mounting shortages in gold and silver.

QE3 was announced on 13-14 September 2012, it was predicted that they would by MBS and bonds, Eric Sprott premiums on silver went up, bond yields went up, LCNS went up, silver broke out.

All predicted in this August 2012 article.

Now the only thing that remains is the JPM silver manipulation. That will ultimately happen when physical shortages in silver start to emerge and we already see that happening. So brace yourself for a spike in silver!

See Kingworldnews: Mounting shortages in gold and silver.

Friday, 14 September 2012

Capacity Utilization Rate Keeps Climbing in Canada, but not in the U.S.

Posted on 04:55 by Unknown

In Canada the capacity utilization rate has climbed from 80.5% the previous quarter to 81%. As Canada is a resource based economy, this could be an indication that the commodities market will improve in the next quarters. Capacity utilization rates above 80% are inflationary.

http://www.bloomberg.com/news/2012-09-13/canada-second-quarter-capacity-utilization-report-text-.html

U.S. capacity utilization took a dive in August 2012 to 78.2%, much less than the forecast. This is the lowest since October 2011 and a huge break of the trendline. We can't make too much conclusions on this number because QE3 has just been announced and will have an effect on the future.

http://www.bloomberg.com/news/2012-09-13/canada-second-quarter-capacity-utilization-report-text-.html

U.S. capacity utilization took a dive in August 2012 to 78.2%, much less than the forecast. This is the lowest since October 2011 and a huge break of the trendline. We can't make too much conclusions on this number because QE3 has just been announced and will have an effect on the future.

Large Portion of QE3 Goes to Interest Payments on U.S. Debt

Posted on 04:32 by Unknown

On 13 September 2012, Ben Bernanke announced a third round of quantitative easing also known as QE3. What the federal reserve will do is buy $40 billion in MBS and $45 billion in 10-30 year bonds per month. So a year from now, the federal reserve will have bought $480 billion in MBS and $540 billion in 10-30 year bonds.

So basically, the federal reserve will try to spur growth by helping the mortgage market and the bond market. But there is a catch in the deal. What investors need to pay attention to is the yearly interest payment on the U.S. government debt.

As you can see, the interest payments on total U.S. debt (blue dots) follow the total U.S. public debt outstanding (red dots). The higher the U.S. debt, the higher the interest payments on this debt.

What will this mean for investors? Read it here.

|

What will this mean for investors? Read it here.

Monday, 10 September 2012

A Quick Look at the Top 5 Pharmaceutical Companies

Posted on 12:56 by Unknown

While Marc Faber is predicting that the stock market will be lower in a few months, he suggests that investors diversify into the pharmaceutical sector. The reasoning behind this is that during a stock market crash, the pharmaceutical sector will be less hurt by worsening market conditions. Pharmaceutical companies provide a stable dividend and their products are less dependent on economic cycles.

There are many pharmaceutical companies for investors to put their money in, but I suggest to choose for the big companies as you will be sure to get a stable dividend with the lowest risk profile. Smaller biotech companies are too speculative to invest in. I'll discuss the top 5 pharmaceutical companies (by revenue) in this article. These are Johnson and Johnson (JNJ), Pfizer (PFE), Roche (RHHBY.PK), GlaxoSmithKline (GSK) and Novartis (NVS).

When choosing companies in the large pharmaceutical sector, the P/E ratio is the most important. There is a difference between brand-name companies and generic drug companies. The generic drug companies (like TEVA or a division of Novartis) basically sell the same drug as brand-name companies, but at lower prices. Additionally, they don't have the problem of patent expiration. On chart 1 we can see that the P/E ratio for the pharmaceutical sector has been falling, bringing in nice valuations currently at a P/E of 16.6 for big pharma and a P/E of 18 for generic drug pharma.

A summary of the P/E ratios for the 5 top pharmaceutical companies is given in table 1. Based on this table, GlaxoSmithKline would be the most inexpensive company.

However, there are other things to consider when choosing to invest in a pharmaceutical company. It is important to look at the dividend and the product pipeline of the company, especially their "patent cliffs".

Read about it here.

There are many pharmaceutical companies for investors to put their money in, but I suggest to choose for the big companies as you will be sure to get a stable dividend with the lowest risk profile. Smaller biotech companies are too speculative to invest in. I'll discuss the top 5 pharmaceutical companies (by revenue) in this article. These are Johnson and Johnson (JNJ), Pfizer (PFE), Roche (RHHBY.PK), GlaxoSmithKline (GSK) and Novartis (NVS).

When choosing companies in the large pharmaceutical sector, the P/E ratio is the most important. There is a difference between brand-name companies and generic drug companies. The generic drug companies (like TEVA or a division of Novartis) basically sell the same drug as brand-name companies, but at lower prices. Additionally, they don't have the problem of patent expiration. On chart 1 we can see that the P/E ratio for the pharmaceutical sector has been falling, bringing in nice valuations currently at a P/E of 16.6 for big pharma and a P/E of 18 for generic drug pharma.

|

| Chart 1: P/E Ratio Pharma |

|

| Table 1: P/E Ratio of Big Pharma |

Read about it here.

Saturday, 8 September 2012

China Gold Import from Hong Kong Positive in July

Posted on 13:19 by Unknown

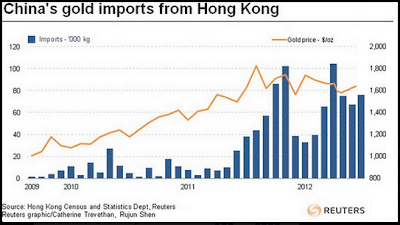

Very important trend reversal in July.

We thought the gold imports of China were declining, but in July 2012 the trend has gone to the upside once again. July gold imports from Hong Kong were 75.84 tons to be exact.

|

| Chart 1: China Gold Imports from Hong Kong |

Friday, 7 September 2012

Payrolls Rose 91000, less than forecast

Posted on 05:51 by Unknown

Payroll numbers just came out and it's not good: 91000.

As I pointed out in this article it means we are bound to get higher unemployment numbers (even though unemployment is only 8.1% right now). This is because payroll numbers are a far better measure than the unemployment rate.

What happened? Gold and silver flew through the roof because QE3 is very probable now.

As I pointed out in this article it means we are bound to get higher unemployment numbers (even though unemployment is only 8.1% right now). This is because payroll numbers are a far better measure than the unemployment rate.

What happened? Gold and silver flew through the roof because QE3 is very probable now.

|

| Chart 1: Silver |

|

| Chart 2: Gold |

China Acts: 1 trillion yuan stimulus on Infrastructure

Posted on 04:55 by Unknown

China has acted with a big infrastructure stimulus plan of 1 trillion yuan. This is equivalent to 160 billion dollars. With GDP of China being half of that of the U.S., this means it is equivalent to a 320 billion dollar stimulus in the U.S. This is a pretty big stimulus if you tell me.

You know what that means. Buy commodities and stocks.

http://www.businessinsider.com/chinese-market-goes-wild-after-1-trillion-yuan-stimulus-plan-2012-9

You know what that means. Buy commodities and stocks.

http://www.businessinsider.com/chinese-market-goes-wild-after-1-trillion-yuan-stimulus-plan-2012-9

Eurobonds in Favor Against U.S. Bonds

Posted on 01:14 by Unknown

In a previous article in March 2012 I pointed out that it was the perfect time to get out of U.S. bonds and go into eurobonds. Just recently we have a huge confirmation that the market is favoring European bonds (EU) over U.S. bonds (TLT) (Chart 1). We see that the WisdomTree Dreyfus Euro ETF (EU) has shot upwards on 21 August 2012 on news that the ECB would buy Italian and Spanish bonds. That day, the euro jumped to a seven-week peak against the U.S. dollar.

|

| Chart 1: TLT Vs. EU |

U.S. bonds yields have not kept pace (yields have not risen) with the rise of european bonds according to the correlation in Chart 1. So investors should quickly take action. Read more here.

Thursday, 6 September 2012

Mike Maloney Survives Car Crash

Posted on 14:36 by Unknown

Mike Maloney is one of those people I look up to and I just heard about his incredible story about him being in a frontal car crash.

http://goldsilver.com/article/mike-maloney-in-horrible-car-crash-with-tesla/

Luckily, Mike survived this car crash and I'm glad nothing of permanent damage was incurred.

I always say: "you can have all the gold and silver on this world, but health will always come first."

http://goldsilver.com/article/mike-maloney-in-horrible-car-crash-with-tesla/

Luckily, Mike survived this car crash and I'm glad nothing of permanent damage was incurred.

I always say: "you can have all the gold and silver on this world, but health will always come first."

Wednesday, 5 September 2012

Peter Schiff Goes Undercover: DNC Convention 2012

Posted on 14:47 by Unknown

Peter Schiff goes undercover at the Democratic National Convention (DNC) convention in North Carolina.

Top notch comedy! Peter is talking the complete opposite of his own opinions and shows how ridiculous it sounds.

Is it too late to buy Silver Lake Resources?

Posted on 13:53 by Unknown

Silver Lake Resources (SLR) is one of those Australian gold companies that has defied gravity in the gold mining industry. While the 2008 economic crisis hit the whole world, Silver Lake Resources managed to return more than a 1000% in gains starting from year 2008 up to today (Chart 1). The question is, how much can it still go up?

Find out the answer here.

Find out the answer here.

|

| Chart 1: Silver Lake Resources (SLR) |

CME adds Silver Stock Depository: CNT DEPOSITORY, INC.

Posted on 08:28 by Unknown

Today the CNT Depository has been added to the already existing warehouse stock depositories at the COMEX (CME): Brink's, J.P. Morgan Chase Bank, Scotia Mocatta, HSBC Bank, Delaware Depository. The CNT Depository is located at 722 Bedford St., Bridgewater, MA. CNT, Inc. began as a small numismatic business in 1973. Since that time they have grown into the largest privately owned company in the precious metals industry. CNT, Inc. has an annual net revenue of $8 Billion in 2011. Other than silver, the company also distributes platinum, palladium and gold.

The initial amount of silver currently deposited is from the eligible class and is in the amount of 631389 troy ounce or 0.4% of the total silver stock at the COMEX. This amount is so small that there shouldn't be any effect at all on the other competing depositories.

Investors have an extra alternative at hand now to store their physical silver (SLV) bullion.

As for the silver warehouse stock level at the COMEX (Chart 1), it has been in a rising trend since August 2012, which possibly means there is a temporary declining demand in silver.

Silver lease rates (Chart 2) have been declining sharply and investors need to watch out for a spike in lease rates, which accompanies a drop in the price of silver.

I advise investors to at least put a stop limit in silver in case the silver price plunges.

Chart 2: Silver Lease Rates |

The reason why I anticipate a correction in the silver price is because technically, the silver price is overbought, with the MACD topping out for the 1 year silver chart (Chart 3).

As for the long/short positions in silver, we noted that the LCNS level has increased quite a bit, indicating higher silver prices in the future as I pointed out in this article.

Last but not least, the premium on silver has been rising slowly and based on historic correlations, this is bullish for the price of silver (Chart 5).

| (click to enlarge) |

| Chart 5: Sprott Physical Silver (PSLV) Premium |

Conclusion:

Overall I'm bullish on the silver price considering the macroeconomic indicators of rising debt, extra QE stimulus, rising unemployment. But the short term technical indicators point to a possible short term correction. It's advisable that investors put a stop limit on their silver positions in case of a plunge in the silver price.

Tuesday, 4 September 2012

U.S. Debt at 16 Trillion

Posted on 14:07 by Unknown

It's official, U.S. debt has exceeded 16 trillion dollars. It's like having a birthday or something, but we shouldn't celebrate.

|

| Chart 1: Total Public Debt |

Gold - Silver Ratio breaks down

Posted on 09:15 by Unknown

The gold - silver ratio has finally started to break down and there is still a ways to go lower.

That means you buy silver turbos or AGQ.

That means you buy silver turbos or AGQ.

|

| Chart 1: Gold Silver Ratio |

Subscribe to:

Comments (Atom)