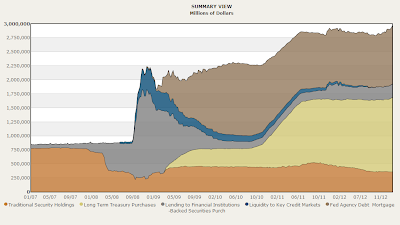

As of this week, the Federal Reserve has officially gone over $3 trillion in its balance sheet. It is buying MBS and bonds as promised. Of course this has consequences as I pointed out here. The euro made a 1 year high against the U.S. dollar. U.S. bond yields are breaking resistance at 1.92% yield on the 10 year treasuries.What's very odd is that the gold price keeps languishing. A weak dollar environment should be very bullish for gold.Chart 1:...