Following list gives the most important indicators for the future of a currency:

- Current account balance of the country

- Total national debt of the country

- Inflation rate

- Interest rate

The larger the national debt of the country, the more expensive it will be to sell debt to foreigners. The government will then be obliged to monetize this debt to keep interest rates low and to be able to service this debt. Rising debt load will therefore devalue the currency.

The higher the inflation rate, the lower the currency will go. An example is Vietnam, where the dong lost much of its value due to high inflation.

When interest rates are lower than the inflation rate, there is no incentive for foreigners to buy the currency. There is no incentive to save money. The consequence is a lower currency value.

Let's look at the current statistics:

1) Current account

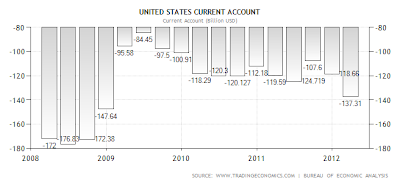

5 months ago, the current account deficit of the US was in the order of $US 110 billion per quarter, which amounted to $US 450 billion per year (2011).

For the Eurozone, the 12-month cumulated seasonally adjusted current account recorded a deficit of EUR 44.9 billion.

Today, the eurozone is posting a current account surplus of 14.9 billion euro in June, while the U.S. is increasing its quarterly deficits to $US 137 billion in the latest quarter.

So in this case, the eurozone is still the winner.

Europe VS USA: 1-0.

|

| Euro Area Current Account (Million euro) |

|

| U.S. Current Account (Billion USD) |

Total US national debt is $US 16 trillion. Total eurozone national debt to GDP is 88.6%, the GDP is $US 17.578 trillion in 2011, which translates to $US 15.6 trillion in Eurozone debt. So again, Europe wins by a small margin.

Europe VS USA: 2-0

3) Inflation Rate

5 months ago, the inflation rate in the Eurozone was 2.6%, while the inflation rate in the U.S. was 2.9%. Today the inflation rate in the Eurozone is 2.4%, while the inflation rate in the U.S. is 1.4%. This is a significant and surprising decline in inflation rate in the U.S Vs. Europe.

Europe VS USA: 2-1.

|

| Euro Area Inflation Rate |

|

| U.S. Inflation Rate |

4) Interest Rate

5 months ago, the interest rate in the Eurozone was 1%, while the interest rate in the US was essentially zero. As we already know, Mario Draghi lowered interest rates to 0.75%, but this is still higher than the interest rate in the U.S. (0.25%). Europe VS USA: 3-1

|

| Euro Area Interest Rate |

|

| U.S. Interest Rate |

Conclusion: Europe still wins by 3-1 against the USA, but is losing ground through inflation. Though I think the current account surplus of Europe is the most important positive indicator of the strength of the euro in the future.

0 comments:

Post a Comment