I wish you all a Happy New Year for a successful 2012 blogging year.

See you in 2013 and here is me playing a medley from Final Fantasy XIII-2 I just arranged for this occasion from my favorite composer Masashi Hamauzu.

|

| Table 1: COFER Q3 2012 |

|

| Chart 1: EUR/USD |

|

| Chart 2: Foreign Exchange Reserves |

|

| Chart 1: Gold Lease Rates |

|

| Chart 1: West/East Gold Reserves |

|

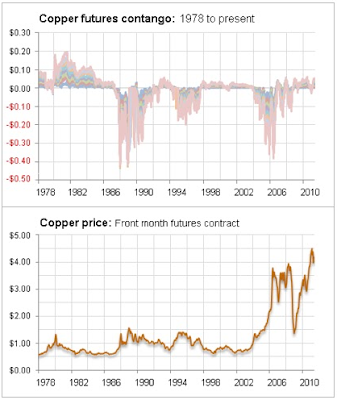

| Chart 1a: Copper Contango Vs. Copper Price |

|

| Chart 1b: Historical Copper contango |

|

| Chart 2: LME Copper Stock |

|

| Chart 1: Bonds Vs. Gold |

|

| Chart 2: Bonds Vs. Gold |

|

| Chart 1: All-in Cost of Gold Mining |

|

| Chart 2: Replacement cost for an ounce of gold |

|

| Chart 1: Open Interest Silver |

|

| Chart 2: LCNS Net Short Positions Silver |

|

| Chart 0: Industrial Production: Manufacturing |

|

| Chart 1: Industrial Production Index |

|

| Chart 2: CRB Metals Sub-Index |

|

| Chart 1: Gold COMEX Stock |

|

| Chart 2: Open Interest Gold |

|

| Chart 3: Silver COMEX Stock |

|

| Chart 4: Open Interest Silver |

|

| Chart 1: Nomura Holdings |

|

| Chart 1: U.S. Unemployment Vs. Capacity Utilization |

|

| Chart 2: Capacity Utilization Belgium |

|

| Chart 3: Unemployment Rate Belgium |

|

| Chart 4: Capacity Utilization Canada |

|

| Chart 5: Unemployment Rate Canada |

|

| Chart 6: Capacity Utilization Euro Area |

|

| Chart 7: Unemployment Rate Euro Area |

|

| Chart 8: Capacity Utilization Japan |

|

| Chart 9: Unemployment Rate Japan |

|

| Chart 1: Iron Ore Consumption by Continent |

|

| Chart 2: Iron Ore Production by Continent |

| (click to enlarge) |

| Chart 1: EUR/USD |

|

| Chart 1: Platinum to Gold Ratio |

|

| Chart 1: COMEX gold |

|

| Chart 1: Copper Price |

|

| Chart 1: LCNS Silver Net Short Positions |

|

| Chart 2: Silver Lease Rates |

|

| Chart 3: COMEX silver stock |

|

| Chart 4: Sprott PSLV premium |

|

| Chart 5: Gold Miners Vs. Gold Price |