As I write this post, I see the copper price go up from $3.53/lb to $3.59/lb.

The next step to extend this copper contango theory is to identify the tops and the bottoms of the contango. What are the upper limits of contango and lower limits of the backwardation?

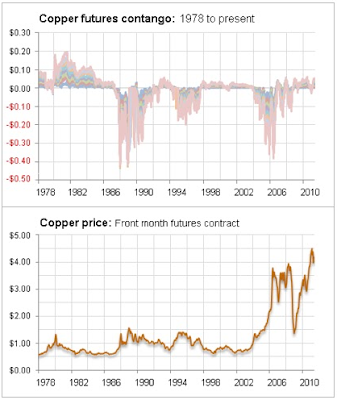

If we quickly look at history, we can see that in 1988, we got a price of $1/lb copper and a backwardation of around $0.2/lb. That's 20%. If we then look at another data point in 1996, we got a price of $1.25/lb and a backwardation of around $0.1/lb. That's 8%. Similarly, in 2006 we got 7%. For contango we have 13% in 1982, 7% in 1993, 2% in 2008.

There is one caution however, the LME copper stock levels are surging in exchange warehouses, which will put a cap on the rise in copper price and may even bring the copper price down.

The next step to extend this copper contango theory is to identify the tops and the bottoms of the contango. What are the upper limits of contango and lower limits of the backwardation?

|

| Chart 1a: Copper Contango Vs. Copper Price |

So as far as major backwardation lows, we have a range between 7% and 20% and 2% to 13% for major contango highs.

Today we are at 0.6% (0.02/3.6) (mild contango), so we are neither in a low or a high range. We are now right in the middle between contango and backwardation, with a small bias to contango. So, to be really sure we have found a bottom in the copper price, the contango to price ratio should go to at least 2%. But when we go back to backwardation like in 1988, 1995 and 2006, the copper price should spike upwards.

|

| Chart 1b: Historical Copper contango |

There is one caution however, the LME copper stock levels are surging in exchange warehouses, which will put a cap on the rise in copper price and may even bring the copper price down.

|

| Chart 2: LME Copper Stock |

0 comments:

Post a Comment