I couldn't believe my eyes when I saw this. Suddenly we saw the J.P. Morgan vault get almost half of the eligible gold converted into registered gold.

I have seen this before... I think someone wants delivery. Let me do some research on this...

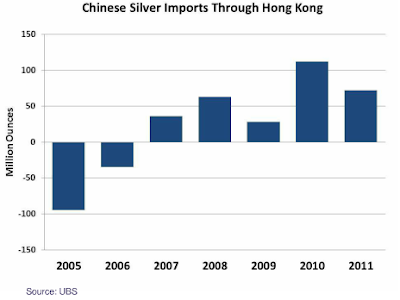

Edit: Yes indeed, we saw J.P. Morgan do the same with silver a year ago here in November 2011 (right before a huge rise in silver price). The consensus was that they are preparing for a large delivery to someone. They increased registered stock to prevent a COMEX default. This is also a sign of loss of confidence in paper gold and silver.

Let's see what happens next, probably a decline in total stock.

Edit: Yes indeed, we saw J.P. Morgan do the same with silver a year ago here in November 2011 (right before a huge rise in silver price). The consensus was that they are preparing for a large delivery to someone. They increased registered stock to prevent a COMEX default. This is also a sign of loss of confidence in paper gold and silver.

Let's see what happens next, probably a decline in total stock.