Latest data shows no deposit flight yet in February 2013. Greece did decline together with Portugal, Ireland and Cyprus. But Italy and Spain had deposit increases.

Sunday, 31 March 2013

Saturday, 30 March 2013

Correlation: Recession Vs. Yield Spread

Posted on 12:12 by Unknown

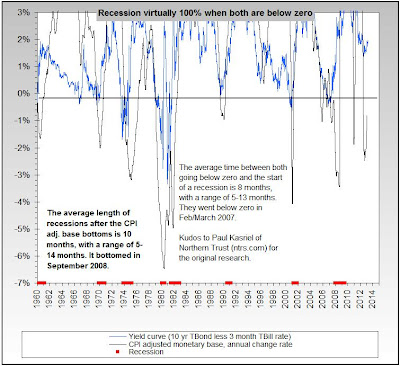

I came across an interesting article that gives an empirical correlation between the yield spread between the 10 year and 3 month treasuries/bill and the probability of a recession when that yield spread narrows.

The key is to monitor that the 10 year yield is always higher than the 3 month yield. If the 10 year yield starts to go closer to the 3 month yield and even goes below it, then we have a high probability of a recession.

That correlation can be witnessed on chart 1. Each time the blue line goes below zero, we have a recession.

The last recession was in 2008. A few years before, the yield spread went to zero. Today we're in pretty safe territory (Chart 2). The green line minus the black line is 2%. If we see the black line go up again or the green line go down, we are in trouble. That's why the Federal Reserve never will increase the fed funds rate. Otherwise the black line will spike upwards.

No problems today. But it pays off to watch the yield spread each month or so.

The key is to monitor that the 10 year yield is always higher than the 3 month yield. If the 10 year yield starts to go closer to the 3 month yield and even goes below it, then we have a high probability of a recession.

That correlation can be witnessed on chart 1. Each time the blue line goes below zero, we have a recession.

|

| Chart 1: Recession Vs. Yield Spread |

The last recession was in 2008. A few years before, the yield spread went to zero. Today we're in pretty safe territory (Chart 2). The green line minus the black line is 2%. If we see the black line go up again or the green line go down, we are in trouble. That's why the Federal Reserve never will increase the fed funds rate. Otherwise the black line will spike upwards.

No problems today. But it pays off to watch the yield spread each month or so.

|

| Chart 2: U.S. bond yields |

This theory is applicable to every country. I analyzed Spain for example in this article.

| Chart 3: Spanish Bond Yields (10 year vs 2 year) |

Thursday, 28 March 2013

Belgium the next country to fall

Posted on 11:22 by Unknown

As I said before here and here, Belgium is the next domino to fall after Greece.

If you don't believe me, believe Zerohedge. As you can see on chart 1, the countries on the left have the least equity/capital reserves as a percent of deposits.

So to avert insolvency of Belgian banks, depositors need to be thrown into the fire eventually. But luckily, Greece will be first...

Prepare yourself.

If you don't believe me, believe Zerohedge. As you can see on chart 1, the countries on the left have the least equity/capital reserves as a percent of deposits.

So to avert insolvency of Belgian banks, depositors need to be thrown into the fire eventually. But luckily, Greece will be first...

Prepare yourself.

| Chart 1: % bad debt that can be impaired before deposit haircuts |

Shanghai precious metals premiums fall to zero

Posted on 09:44 by Unknown

Bad news, gold premium in Shanghai has reached 0%. It is not the time to buy gold right now.

Tuesday, 26 March 2013

Copper Contango Update

Posted on 14:52 by Unknown

I have the feeling that we are going to make a bottom in copper soon, the contango will at one point begin to reverse. We are at 1.4% contango to price ratio now, it will go up to about 2-5% before it will reverse. Even when we have a copper surplus and record copper stocks in China.

The CFTC data shows that copper will most likely go up because large commercials are long.

|

| Chart 1: Copper Contango Vs. Copper Price |

The CFTC data shows that copper will most likely go up because large commercials are long.

Monday, 25 March 2013

Bank Reserve Requirements in the Eurozone

Posted on 09:24 by Unknown

Following the crisis in Cyprus of which I talked about here, there has been a question on how much stress the banks can have during a bank run, before their liquidity is at stake.

A typical bank balance sheet looks like this (Figure 1). If the deposits get drained on the right side, the cash gets drained on the left side. The question is, how high is the limit of a drain on deposits?

Let's analyze the bank reserve requirements first.

Then we look at the capital and reserves of the banks. The capital and reserves are given in the last column (Table 1).

A typical bank balance sheet looks like this (Figure 1). If the deposits get drained on the right side, the cash gets drained on the left side. The question is, how high is the limit of a drain on deposits?

|

| Figure 1: Balance Sheet |

Let's analyze the bank reserve requirements first.

|

| Chart 1: Reserve Requirements |

Then we look at the capital and reserves of the banks. The capital and reserves are given in the last column (Table 1).

|

| Table 1: Bank Statistics |

Saturday, 23 March 2013

Belgium deposits are not safe

Posted on 23:46 by Unknown

I happen to live in Belgium and there are some people there arguing with me about gold. I keep telling them to buy gold but they insist not to buy it.

What they don't take in account is that Belgium is the next in line of the PIIGS. Belgium has one of the largest debts in the Eurozone and has the highest taxes. As a result I don't think that higher taxes will be an option.

So the only other option is to take your deposits like in Cyprus. Belgium happens to have a lot of uninsured deposits ready for the taking (Chart 1).

With this chart I will have another argument up my sleeve. Of course I already prepared myself by taking all my money out of the bank.

Friday, 22 March 2013

Correlation: 30 Yr. Treasury Yield Vs. 30 Yr. Mortgage Rates

Posted on 11:28 by Unknown

Just wanted to add another couple of correlations to my collection. We will learn about fixed and adjustable rate mortgages. These are correlated against treasury yields and fed funds rate respectively.

1) Conventional (Fixed) Mortgage Rate Vs. Treasury Yields

As you can see mortgage rates are always higher than treasury yields because U.S. treasuries are considered much safer than mortgages.

2) Adjustable Mortgage Rate Vs. Fed Funds Rate

Adjustable Rate Mortgages on the other hand are linked to the Fed Funds Rate.

|

| Chart 1: 30 Yr. Treasury Yield Vs. 30 Yr. Mortgage Rate |

Adjustable Rate Mortgages on the other hand are linked to the Fed Funds Rate.

|

| Chart 2: 1 Yr. Adjustable Rate Mortgage Vs. Fed Funds Rate |

Correlation: Disposable Income Vs. Housing Prices: Is there a housing bubble?

Posted on 10:17 by Unknown

Peter talked a lot about housing on the radio show of 21 March 2013. He said that house prices could drop a lot from here, but I don't agree with that.

To see where housing prices will go we need to look at 3 fundamentals. The most important one is wages and income. If your monthly disposable income doesn't match with the house you are buying, you will not be able to pay off your house. The second factor is mortgage rates. If you need to pay an ever increasing higher interest, you will have difficulties to pay off your house (at an adjustable rate mortgage). The last factor is savings. If you don't have a pool of savings, you can't make an adequate down payment for your house.

Let's analyze these 3 fundamentals in this article.

To see where housing prices will go we need to look at 3 fundamentals. The most important one is wages and income. If your monthly disposable income doesn't match with the house you are buying, you will not be able to pay off your house. The second factor is mortgage rates. If you need to pay an ever increasing higher interest, you will have difficulties to pay off your house (at an adjustable rate mortgage). The last factor is savings. If you don't have a pool of savings, you can't make an adequate down payment for your house.

Let's analyze these 3 fundamentals in this article.

Thursday, 21 March 2013

COMEX Gold Data Update

Posted on 14:42 by Unknown

This is what incomplete COMEX gold stock data looks like after a laptop crash.

Nevertheless you can see that total gold stock is declining very rapidly and the most important of all, it is a real trend changer. Look at how soft the curve was before and suddenly everyone takes their gold back starting from 2013.

I think we are in for a rally. Especiallly in silver, where open interest is still very high.

List of All Discovered Correlations

Posted on 11:26 by Unknown

Once in a while I need to post an update on all discovered correlations, we're getting a huge list already. If I only had some software to get automatic updates of these charts...

Positive correlations mean that if one goes up, the other goes up too. Negative correlations mean that if one goes up, the other goes down.

Positive correlations:

1) Silver premium Vs. Silver Price

2) Baltic Dry Vs. Industrial Commodities

3) Baltic Dry Vs. Copper

4) Copper Vs. S&P

5) Oil Vs. Dow Jones

6) Agriculture Price Vs. Health of Economy

7) Agriculture Vs. Fertilizer Price

8) CRB Index Vs. Commodity prices (oil, agriculture, metals)

9) MZM velocity Vs. Inflation

10) MZM velocity Vs. 10 year U.S. treasury yield

11) Case-Shiller Index Vs. Housing Market Index

12) Capacity Utilization Vs. Inflation

13) Rhodium Price Vs. Automotive Industry

14) Housing Price Vs. Rise of Wages

15) O-metrix Score Vs. Stock Value

16) Outlay Spending Vs. Hyperinflation

17) Gold Money Index Vs. Gold Price

18) Stock Dividend to Bond Yield ratio Vs. Stock Price

19) War Vs. Silver Price

20) Exchange Rate Vs. Treasury Bond Valuation

21) PMI Vs. GDP Growth Rate

22) Gold Lease Rate Vs. Gold Price

23) Economy of Australia/Canada Vs. Industrial Commodities

24) Jim Sinclair's Fed Custodials Vs. Gold Price

25) LCNS silver net short positions Vs. Silver Price

26) ECB Deposit Rate Vs. Euribor and Deposit Facility

27) China Gold Imports from Hong Kong Vs. Gold Price

28) AUD/USD Vs. Iron Ore

29) Chinese yoy GDP growth Vs. Chinese yoy Power Consumption

30) Chinese yoy Power Consumption Vs. Chinese yoy Power Production

31) M1 and Gold

32) Obesity Vs. Debt

33) Global Equity Prices Vs. Global EPS revisions

34) Total Public Debt Vs. Interest Payment on Debt

35) U.S. Bond Yields Vs. Interest Payment on Debt

36) Federal Reserve Balance Sheet Vs. S&P

37) Federal Reserve Balance Sheet Vs. Gold Price

38) Balance Sheet Ratio Fed/ECB Vs. EUR/USD

39) China Manufacturing PMI Vs. Base Metal Prices

40) COMEX stock level Vs. CFTC Open Interest

41) Manufacturing component of Industrial Production Vs. CRB Metals Index

42) Net Short Interest Gold Vs. Gold Price

43) Central Bank Net Gold Buying Vs. Gold Price

44) LCNS silver Vs. Silver Open Interest

45) Bond Yields Vs. Gold Price

46) Gold Miners Bullish Percent Index Vs. GDX

47) Daily Sentiment Index Gold Vs. Gold Price

48) Commercial Net Short Interest Vs. Silver Price

49) Food Stamp Participation Rate Vs. Unemployment Rate

50) Bitcoin Price Vs. Gold Price

51) Credit Expansion Vs. Economic Health (second link)

52) Gold Volatility Vs. Gold Price

53) Total Stock Market Index Vs. GDP

54) Brent Crude Oil Vs. WTI Crude Oil

55) EPS revisions Vs. P/E Ratio

56) Citigroup Surprise Index (CESI) Vs. S&P

57) EPS revisions Vs. S&P

58) Dow Theory: Dow Jones Transportation Average Vs. Dow Jones Industrial Average

59) Margin Balance Vs. S&P

60) Federal Debt Growth Vs. 10 Year Treasury Yields

61) Fed Funds Rate Vs. 10 Year Treasury Yields

62) Total Central Bank Balance Sheet Vs. Gold Price

63) Large Commercial Short in Copper Vs. Copper Price

64) Bond Yields (<3%) Vs. P/E Ratio

65) ECB Lending (LTRO) Vs. Deposits at Banks

66) Disposable Income Vs. Housing Prices

67) Fixed (conventional) Mortgage Rate Vs. Treasury Yields

68) Adjustable Mortgage Rate Vs. Federal Funds Rate

69) Silver Vs. Bitcoin

70) Open Interest Trend Vs. Price Trend

71) Wage Inflation Vs. Consumer Price Index (CPI)

72) Marginal Cost of Gold Suppliers Vs. Gold Price (link 2)

73) Durable Goods Orders Vs. S&P

74) Gold ETF Trust (GLD) Vs. Gold Price

75) PMI (leading indicator) Vs. S&P Revenues

76) Federal Funds Rate Vs. LIBOR Rate

77) Lumber Price (leading indicator) Vs. Housing

78) Building Permits (leading indicator) Vs. Housing

79) Pending Home Sales Vs. Mortgage Applications

80) Employment-Population Ratio Vs. Real GDP per Capita

Negative correlations:

1) Copper Price Vs. Copper Futures Contango

2) Interest Rates (bond yields >3%) Vs. P/E ratio of gold mines

3) Non-Farm Payrolls Vs. Unemployment Rate

4) Federal Debt Held by Foreigners Vs. U.S. Bond Yields

5) Size of Governments Vs. Their Economies

6) Stocks Vs. U.S. Dollar

7) Silver Stock at CME Vs. Silver Price

8) China Reserve Requirements Vs. Shanghai Real Estate Prices

9) Capacity Utilization Vs. Unemployment Rate

10) Net Commercial Short Positions Vs. Bond Yields (Alternative Site)

11) Net Non-Commercial Long Positions Vs. Bond Yields

12) % Change in Gold Vs. Real Interest Rates on 10 Year Treasuries

13) Shanghai Silver Premium Vs. Silver Price

14) Probability of Recession Vs. 10 year - 3 year Yield Spread

15) Junk Silver Premium Vs. Silver Price

16) Wage Inflation Vs. Unemployment Rate

17) Initial Unemployment Claims Vs. S&P

18) Gold/Silver Ratio Vs. S&P

19) GLD Flows Vs. Shanghai Gold Premium

20) Unemployment Rate Vs. Real GDP

21) Mortgage Rates Vs. Mortgage Applications

22) Single Family Housing Starts Vs. Unemployment Rate

23) Tax Revenue Vs. Personal Savings Rate

These are a lot of correlations that you need to monitor on a day to day basis!

Correlation: Deposits Vs. LTRO: How to monitor deposits of Eurozone banks

Posted on 10:56 by Unknown

Now that everyone is scared of the bank runs, it is necessary to monitor the deposits at the peripheral countries.

The data is available at the ECB site:

I compiled the data for the most important countries to watch, namely, the PIIGS. And of course Cyprus.

If Cyprus falls, let's see what will happen to the PIIGS. Probably they will fall too.

I will give a monthly update on this.

I challenge you: do you see a correlation here between deposits and something else?

Yes, it's the ECB's LTRO lending to banks (Chart 2). The country that gets the most LTRO will have the most deposits on their banks. That's because most of the deposits just stay on the balance sheets of the banks. Normally loans should go up, but that's not the case anymore since 2008. The deposit to loan ratio is going up (Chart 3).

If all people take their money out of the bank, we get a bank run. Result is that the loans will disappear and go bad. We get an entire collapse in the financial system. So I expect to see LTRO coming back soon as Chart 1 tells us that deposits are again decreasing.

I compiled the data for the most important countries to watch, namely, the PIIGS. And of course Cyprus.

|

| Chart 1: Total Deposits of Peripheral Eurozone Countries |

I will give a monthly update on this.

I challenge you: do you see a correlation here between deposits and something else?

Yes, it's the ECB's LTRO lending to banks (Chart 2). The country that gets the most LTRO will have the most deposits on their banks. That's because most of the deposits just stay on the balance sheets of the banks. Normally loans should go up, but that's not the case anymore since 2008. The deposit to loan ratio is going up (Chart 3).

|

| Chart 2: ECB Lending to Banks |

|

| Chart 3: Deposit to Loan Ratio U.S. Banks |

Tuesday, 19 March 2013

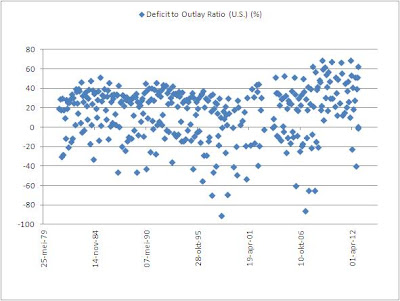

U.S. Deficit Spikes

Posted on 15:39 by Unknown

As December and January were pretty good months (no deficit), February 2013 marked a record deficit of $204 billion. The deficit to outlay ratio spiked to 60%, way over the hyperinflation ceiling of 40%.

If the U.S. keeps going at this rate, we will see $2 trillion dollars in deficit soon.

|

| Chart 1: Deficit to Outlay Ratio |

Bitcoin Exploding on Cyprus

Posted on 15:26 by Unknown

And if you hadn't noticed, bitcoin just exploded 20% to the upside on the Cyprus news, which bodes well for gold obviously.

What does Cyprus mean to your money?

Posted on 12:25 by Unknown

On 15 March 2013, Cyprus said it will impose a levy of 6.75% on deposits of less than 100,000 euros and 9.9% above that. The measure will raise 5.8 billion euros ($7.5 billion), which implies that we have about 68 billion euro ($85 billion) in deposits in the Cypriot banks. What this means is that each depositor in a Cypriot bank will get a haircut on their savings. This event is actually a very important one in history as it marks the first time that depositors actually lose their money, despite the presence of a deposit insurance. Of course, you can't have deposit insurance without a bailout of the banking system by the IMF. But to have this bailout, depositors need to have a cut (imposed by the IMF). It's sort of a paradox: "from now on deposit insurance is not insured anymore".

Many people think that their deposits are safe when they put their cash in the bank, but they either lose it to inflation or in this case lose it to the government. The result is that investors lose confidence in the banking system and will go to assets like precious metals which don't have counterparty risk.

To read more go here.

Many people think that their deposits are safe when they put their cash in the bank, but they either lose it to inflation or in this case lose it to the government. The result is that investors lose confidence in the banking system and will go to assets like precious metals which don't have counterparty risk.

To read more go here.

Recovery of Shanghai Silver Price Premium Correlation

Posted on 10:02 by Unknown

This data was lost, but as you can see here, by just adding a few data points, it can still give us a good idea of the trend.

Copper Contango Experiment

Posted on 09:35 by Unknown

One of the data that can't be wiped out from my computer is the Copper Contango Experiment.

We see that the contango is widening each day, while copper price is declining. That is a normal thing.

Once the contango reverses, we will see a spike in copper. I don't know when it will reverse though.

Historically we need to go as high as 2-10% contango to mark a bottom in copper price as I pointed out here. Today we are at 0.04/3.5 = 1.1%. So there is still a ways to go.

Historically we need to go as high as 2-10% contango to mark a bottom in copper price as I pointed out here. Today we are at 0.04/3.5 = 1.1%. So there is still a ways to go.

Monday, 18 March 2013

Crash

Posted on 10:40 by Unknown

And my laptop crashed, which means all data from February 2013 onwards is gone...

But now I can start from a clean laptop...

Luckily, this blog is like a backup for me...

(so always backup your things, do it, right now, I'm serious.)

But now I can start from a clean laptop...

Luckily, this blog is like a backup for me...

(so always backup your things, do it, right now, I'm serious.)

Wednesday, 13 March 2013

Kyle Bass: Myron Scholes Global Markets Forum

Posted on 16:08 by Unknown

We need to understand what is happening in Japan, because it is a premonition of what's to come in the U.S.

Kyle Bass explains:

http://media.chicagobooth.edu/mediasite/Viewer/?peid=f15d95d054e8442ab0cc1c60321383101d

Kyle Bass explains:

http://media.chicagobooth.edu/mediasite/Viewer/?peid=f15d95d054e8442ab0cc1c60321383101d

Correlation: Shanghai Silver Premium Vs. Silver Price

Posted on 13:15 by Unknown

There is a potential for a new correlation here. Shanghai Silver Premium Vs. Silver Price.

The premise is that when Shanghai silver premiums are high (against London Silver Prices), then we hit a bottom in the silver price.

Let's see if this correlation makes sense, I need more data points.

Tuesday, 12 March 2013

Update: Copper Contango Experiment

Posted on 12:33 by Unknown

The latest results indicate that the copper bull market is far from over. Contango keeps steepening (Chart 1) and the large commercials have covered their shorts in copper (Chart 2).

Copper will go higher. (as will the stock market probably)

I hope the record amount in copper stock won't put a damper on my contango theory.

I hope the record amount in copper stock won't put a damper on my contango theory.

|

| Chart 1: Copper Contango |

|

| Chart 2: CFTC Copper |

Monday, 11 March 2013

Money Velocity Picking Up?

Posted on 12:40 by Unknown

There are rumors that money velocity is picking up. As I said before, money velocity is very important to watch as it is correlated to U.S. Treasury Yields. If money velocity goes up, yields go up.

We will discuss 2 things:

Go here to find out.

We will discuss 2 things:

1) Is GDP going up?

2) Is MZM growth slowing down?

Go here to find out.

Sunday, 10 March 2013

China Gold Imports from Hong Kong Disappoint

Posted on 08:39 by Unknown

China gold imports plunged in January: 51 tonnes. This was not expected, considering the low gold price in January 2013 ($1660/ounce). The result was a 5% decline in the gold price in February ($1580/ounce).

Net imports were 19.58 tonnes. That's 19.58/51.3 = 38%. That's a steep decline from the previous month, which was 74%. |

| Chart 1: China Gold Imports from Hong Kong |

I don't expect February to be much better as we have the Lunar New Year and a shorter month.

COMEX gold and silver update

Posted on 08:05 by Unknown

I have a small warning here for the COMEX stock.

I predicted that the total gold stock would come down here. That's because I saw a very high surge in registered gold from J.P. Morgan's vault. And several months later the total gold stock hit new lows (Chart 1).

There is a tight gold market right now, as we see lease rates go above 0%. GOFO rates are still at record lows and premiums are highest ever. APMEX premium on silver coins just went to the highest level on Friday, namely 18%.

|

| Chart 1: COMEX gold |

A new thing has happened now in the silver COMEX stock. For the first time this year, we see the eligible silver stock go down. I also see that the registered silver went up, probably the same that has happened with gold. So I expect that total silver will now start to go down and we will see tightness in the silver market. We also see that the commercial shorts have finally covered their shorts.

|

| Chart 2: COMEX silver |

Thursday, 7 March 2013

Correlation: P/E ratio Vs. Bond Yields

Posted on 09:00 by Unknown

A few months ago I said that the P/E ratio would go up when bond yields go down. Apparently today, I read on Zerohedge that it is not black and white. This is only true for yields above 3%.

When we go lower than 3%, the correlation reverses. This is very interesting...

Update: Beleggerscompetitie

Posted on 08:44 by Unknown

On the Belgian Investors Competition, I'm still standing on last place. But let's take a look at the top 10.

We see a lot of the leads stay in the top ten. What do they have in their portfolio?

1) Maarten Janssens: short stocks, Royal Imtech

2) pmanager: ING, long stocks

3) Diddenboyke: short gold, Barco, Adidas, Total, GDF Suez

4) Nicolas812: Gold Fields, long gold, Harmony, short stocks

5) Ghost: China, long stocks, L'oreal, Aegon

6) Yamayoze: short stocks, Gold Fields, Commerzbank

7) DRACHE: Long Stocks, long gold

8) Iduardo: Short stocks, long gold,

9) Freak of Nature: short stocks

10) MasterBrokerT: Gold Fields, Short Stocks

Interesting development. Almost everyone is long gold? And Gold Fields is very attractive by every competitor as they have it all in their portfolio.

Wednesday, 6 March 2013

Peter Schiff: New Hampshire Liberty Forum

Posted on 07:58 by Unknown

Tuesday, 5 March 2013

Swiss Gold Initiative Gets 100000 votes

Posted on 10:59 by Unknown

A year ago in March 2012, 4 Swiss parliament members launched the "Swiss Gold Initiative" to repatriate their gold (GLD) to Switzerland. Today, one year later, we have got the 100000 supporters needed for this initiative.

So not only the Germans will get all of their 3400 tonnes of gold back, now the Swiss repatriation is almost reality.

As of September 2012, the SNB had 55591 million CHF gold (Table 1). That's 59139 million USD gold or 33.4 million ounces of gold or 1040 tonnes of gold. That's one third of Germany's gold and is pretty significant.

Other countries who repatriated their gold are: Ecuador (26 tonnes), The Netherlands (613 tonnes).

The SNB hasn't said where its gold is and also hasn't said if it will repatriate their gold all at once, but if they were to repatriate the gold after a positive referendum, we would be witnessing almost double the amount of the gold that Germany wants to repatriate over 7 years: namely 674 tonnes of gold.

The referendum includes 3 items:

1) The Swiss National Bank should repatriate all of its gold to Switzerland

2) The Swiss National Bank cannot sell its gold

3) The Swiss National Bank should have at least 1/5 of its assets in gold

If this referendum takes place I believe the SNB will sell its excess in euros and European bonds and they will buy gold with it. This will make gold go up in euro terms. Investors can bet on this trade by selling euros and buying gold.

Since a year now, the SNB has pegged its currency against the euro (Chart 1) and has expanded its reserves in euros.

And since 2012 the foreign currency reserves at the SNB have gone up from 250 to 400 billion Swiss francs, as Zerohedge reports (Chart 2). That's an increase of 150 billion Swiss francs. If we compare this number against the amount of gold the SNB needs to buy to have 1/5 of its assets in gold, we get at least 50 billion Swiss francs in gold that needs to be bought on a total balance sheet of 500 billion Swiss francs at the SNB. This is a significant amount and will have an effect on the currency market.

The conclusion is that this will be one of those very bullish events for the price of gold, if it really takes place (because we really aren't sure the referendum will come). We are talking about 1040 tonnes. Together with the German repatriation of 674 tonnes of their gold, we have almost 5% of the world's central bank gold reserves that will be repatriated. This is a significant number and it can spur an avalanche of further repatriations of gold. I also believe this will eventually lead to a rise in gold lease rates as central banks will want their leased gold back.

The key members of the Swiss Gold Initiative can be witnessed below:

So not only the Germans will get all of their 3400 tonnes of gold back, now the Swiss repatriation is almost reality.

As of September 2012, the SNB had 55591 million CHF gold (Table 1). That's 59139 million USD gold or 33.4 million ounces of gold or 1040 tonnes of gold. That's one third of Germany's gold and is pretty significant.

Other countries who repatriated their gold are: Ecuador (26 tonnes), The Netherlands (613 tonnes).

The SNB hasn't said where its gold is and also hasn't said if it will repatriate their gold all at once, but if they were to repatriate the gold after a positive referendum, we would be witnessing almost double the amount of the gold that Germany wants to repatriate over 7 years: namely 674 tonnes of gold.

The referendum includes 3 items:

1) The Swiss National Bank should repatriate all of its gold to Switzerland

2) The Swiss National Bank cannot sell its gold

3) The Swiss National Bank should have at least 1/5 of its assets in gold

If this referendum takes place I believe the SNB will sell its excess in euros and European bonds and they will buy gold with it. This will make gold go up in euro terms. Investors can bet on this trade by selling euros and buying gold.

Since a year now, the SNB has pegged its currency against the euro (Chart 1) and has expanded its reserves in euros.

| (click to enlarge) |

| Chart 1: EUR/CHF |

| (click to enlarge) |

| Chart 2: Swiss National Bank Balance Sheet |

The conclusion is that this will be one of those very bullish events for the price of gold, if it really takes place (because we really aren't sure the referendum will come). We are talking about 1040 tonnes. Together with the German repatriation of 674 tonnes of their gold, we have almost 5% of the world's central bank gold reserves that will be repatriated. This is a significant number and it can spur an avalanche of further repatriations of gold. I also believe this will eventually lead to a rise in gold lease rates as central banks will want their leased gold back.

The key members of the Swiss Gold Initiative can be witnessed below:

Update: Copper Contango Experiment

Posted on 09:11 by Unknown

Since 2013, the copper contango Vs. copper price correlation hasn't worked at all.

Both curves, blue and red are going up and down in tango, which is not normal. I wonder when the correlation will set in again, like it always had throughout history.

Monday, 4 March 2013

Correlation: Large Commercial Shorts in Copper Vs. Copper Price

Posted on 08:34 by Unknown

Just for Discerning Admirer I looked at the CFTC report for Dr. Copper.

PS: I haven't found a correlation between LME copper stock and copper price yet.

The same correlations as in silver and gold can be found here. When large commercials go short, we hit a top in the copper price. When large commercials cover their shorts and go long, the copper price bottoms out.

In the most recent February 2013 smackdown of copper we see that a lot of shorts have covered their short positions in copper. The red bars were very negative (a lot of commercial short interest), but those negative red bars have now subsided back to zero.

That means I expect that the copper smackdown has run its course for now.

This report, together with the contango report should give us an idea of the trend in the copper price. I can't wait to see the contango report for tomorrow.

I emphasize: this is only an indicator for short term moves. For long term moves you should always look at the contango report. The contango report says we are still in contango, which means the copper price will go up.

I emphasize: this is only an indicator for short term moves. For long term moves you should always look at the contango report. The contango report says we are still in contango, which means the copper price will go up.

|

| Chart 1: CFTC Report Copper |

|

| Chart 2: Copper Price |

Sunday, 3 March 2013

Correlation: Total Central Bank Balance Sheet Vs. Gold Price

Posted on 01:12 by Unknown

I once said there was a correlation between the Federal Reserve balance sheet and the gold price. As a result there is also a correlation between M1 and the gold price. This is still the case.

Even though the Federal Reserve balance sheet has been going up due to QE3, there is one central bank that did the opposite recently. That dreaded central bank is the ECB.

As you can see on Chart 2, the ECB has shrinked its balance sheet due to the repayment of LTRO. European banks paid off 137 billion euro on 25 January 2013. So you can see the dip here.

That repayment of LTRO coincided with a rise in the EUR/USD (Chart 3).

And a drop in gold price in euros.

So forget complacency in the Eurozone as reason for the dropping gold price. Just look at the balance sheet of the ECB as primary reason.

But gold is universal, so you should look at the balance sheets of every central bank in the world.

|

| Chart 1: Total Central Bank Assets |

As you can see on Chart 2, the ECB has shrinked its balance sheet due to the repayment of LTRO. European banks paid off 137 billion euro on 25 January 2013. So you can see the dip here.

|

| Chart 2: ECB Assets |

|

| Chart 3: EUR/USD |

And a drop in gold price in euros.

|

| Chart 4: Gold Price in Euro |

So forget complacency in the Eurozone as reason for the dropping gold price. Just look at the balance sheet of the ECB as primary reason.

We may not forget that the ECB has one of the largest balance sheet in the world (after China) and we need to monitor their balance sheet even more than the Federal Reserve balance sheet. Japan should be monitored closely too.

You can monitor the ECB balance sheet here.

For the Japanese balance sheet you must google it.

Saturday, 2 March 2013

Total Credit Market Debt

Posted on 02:32 by Unknown

Since 2008 we have started a new era. We entered the period of deleveraging. For more than half a decade we had an exponential growth system in credit, but we have ended this period. I will show you by analyzing "Total Credit Market Debt".

Total Credit Market Debt today, is at an astonishingly $55.3 trillion dollars.

And it is 350% of GDP.

The total credit market debt = federal/state/local government debt + federal debt to trust funds + business debt + household debt + domestic financial sector debt.

This total credit market debt can be divided by federal debt and private debt.

1) Federal debt: $16.7 trillion.

Federal debt is at 100% of GDP.

2) Private debt: $40 trillion.

Private debt is at 245% of GDP.

As you can see, since 2008, the private sector has been deleveraging (Chart 6) and the Federal Reserve has been preventing this to happen (Chart 4).

But overall, the Federal Reserve hasn't printed enough money to keep debt going up exponentially (Chart 1).

So what happens when debt doesn't grow exponentially? You will get an economic collapse as Chris Martenson explains here.

To read the analysis: go here.

Total Credit Market Debt today, is at an astonishingly $55.3 trillion dollars.

|

| Chart 1: Total Credit Market Debt Owed |

|

| Chart 2: Total Credit Market Debt as a Percentage of GDP |

This total credit market debt can be divided by federal debt and private debt.

1) Federal debt: $16.7 trillion.

|

| Chart 3: Federal Debt: Total Public Debt |

|

| Chart 4: Federal Debt: Total Public Debt as a % of GDP |

|

| Chart 5: Private Debt |

|

| Chart 6: Private Debt as a percentage of GDP |

But overall, the Federal Reserve hasn't printed enough money to keep debt going up exponentially (Chart 1).

So what happens when debt doesn't grow exponentially? You will get an economic collapse as Chris Martenson explains here.

To read the analysis: go here.

Correlation: Fed Funds Rate Vs. 10 Year Bond Yields

Posted on 02:17 by Unknown

Another correlation Azizonomics taught me is the Fed Funds Rate Vs. 10 Year Bond Yield (Chart 1).

As long as the federal reserve keeps interest rates at zero, there is no way the 10 year bond yield will go up.

If you think about this, we have 2 forces. One is debt growth (Chart 2), which is skyrocketing and the other one is the fed funds rate (Chart 1) which is at historic lows. Debt growth induces higher bond yields and low interest rates are inducing lower bond yields. I wonder which force will eventually win.

If the Federal Reserve even thinks about setting higher interest rates, the bond market will immediately collapse!

As long as the federal reserve keeps interest rates at zero, there is no way the 10 year bond yield will go up.

|

| Chart 1: Fed Funds Rate Vs. 10 Year Bond Yields |

|

| Chart 2: Public Debt Growth Vs. 10 Year Bond Yields |

Correlation: 10 Year Bond Yields Vs. Total Public Debt Growth

Posted on 02:05 by Unknown

Azizonomics taught me another correlation. When debt grows faster (red line goes up), normally the treasury yield should go up.

But from year 2000 onwards it didn't happen. Either the treasury yields should go up, or the debt growth should slow down.

|

| Chart 1: Federal Debt Growth Vs. 10 Year Bond Yields |

Subscribe to:

Comments (Atom)