Today, Croatia joined the European Union, time to celebrate! But should we really celebrate?

What we took in the European Union is a bunch of problems.

First off, the unemployment rate of Croatia is a staggering 20%, rivalling with Spain and Greece.

Second, its balance of trade is negative and has always posted a trade deficit.

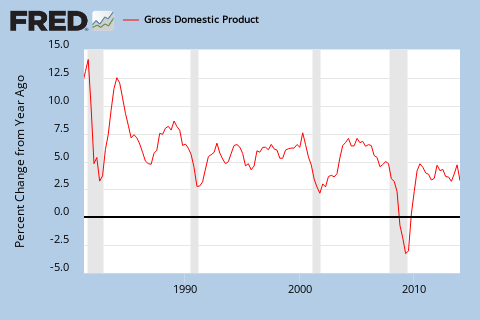

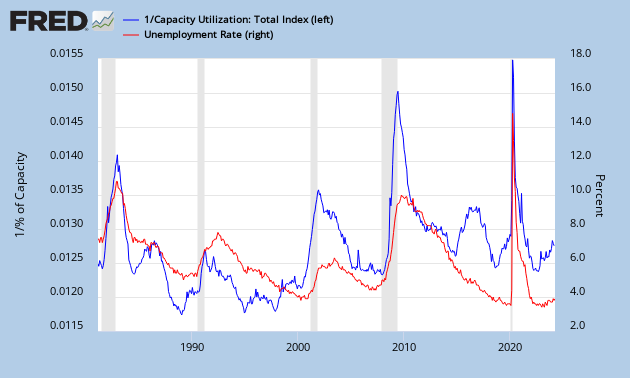

To make matters worse, since 2008, the country was in recession and is still in a recession. Added to this, there is an almost 5% inflation in the country (which has come down to 2% just recently), which makes real GDP decline even more rapidly. As we have seen recently in this correlation, it doesn't bode well for the unemployment rate, which will keep rising.

This decline in GDP quickly added to the government's debt. A positive point is that the government debt to GDP is still at 54%, which is good. But it is worsening. External debt though, is higher at around 90% of GDP.

As debt goes up, the country's bonds had been downgraded to junk status last year. This creates the possibility of a bail out of the country by the IMF once it joins the Eurozone.

What a gift.

What we took in the European Union is a bunch of problems.

First off, the unemployment rate of Croatia is a staggering 20%, rivalling with Spain and Greece.

Second, its balance of trade is negative and has always posted a trade deficit.

To make matters worse, since 2008, the country was in recession and is still in a recession. Added to this, there is an almost 5% inflation in the country (which has come down to 2% just recently), which makes real GDP decline even more rapidly. As we have seen recently in this correlation, it doesn't bode well for the unemployment rate, which will keep rising.

This decline in GDP quickly added to the government's debt. A positive point is that the government debt to GDP is still at 54%, which is good. But it is worsening. External debt though, is higher at around 90% of GDP.

As debt goes up, the country's bonds had been downgraded to junk status last year. This creates the possibility of a bail out of the country by the IMF once it joins the Eurozone.

What a gift.